Free Consultation: (888) 884-8686Tap to Call This Lawyer

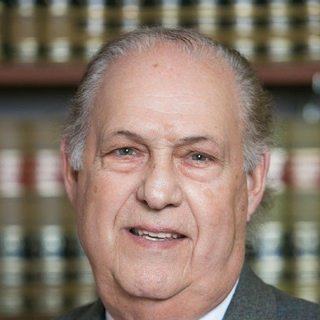

Stanley H Block

Your Trusted Source for Tax Problem Resolution

Badges

Claimed Lawyer ProfileQ&A

Biography

I am law professional working in IRS representation and tax problem resolution. My firm has over 100 years of combined experience in dealing with the IRS and their collection process. Your tax situation will be thoroughly analyzed by our team that includes a tax attorney and tax professionals, and together we will decide the best course of action to help solve your IRS problems - FOR GOOD!

Practice Area

- Tax Law

- Business Taxes, Criminal Tax Litigation, Estate Tax Planning, Income Taxes, International Taxes, Payroll Taxes, Property Taxes, Sales Taxes, Tax Appeals, Tax Audits, Tax Planning

Additional Practice Area

- Tax Resolution

Fees

-

Free Consultation

Free Consultation if $10k or more is owed to IRS or Maryland. Or if you have more than two years of unfiled returns. -

Credit Cards Accepted

all major credit cards accepted. -

Rates, Retainers and Additional Information

Our firm works with individuals and businesses of all income levels. We are always happy to discuss flexible payment plans for our fees.

Jurisdictions Admitted to Practice

- Maryland

-

- Federal Circuit

-

Languages

- English: Spoken, Written

Professional Experience

- Attorney

- SH Block Tax Services Inc

- - Current

Education

- University of Baltimore School of Law

- (1961) Law

- -

- Honors: Top 10% of class

- Activities: Title abstraction for the Maryland Title Company, Claims adjustor for the Maryland Casualty Insurance, President of the Twin District Democratic Club, and Secretary of Law Fraternity.

-

Awards

- Top Practitioner

- The American Society of Tax Problem Solvers

Professional Associations

- Maryland Volunteer Lawyers Service, Inc.

- Attorney

- Current

-

- American Society of IRS Problem Solvers

- Member

- - Current

-

Publications

Articles & Publications

- Maryland drops the ball in notifying taxpayers

- The Daily Record (Maryland)

- Tax Amnesty Program Returns After 6 Year Hiatus

- The Daily Record (Maryland)

Certifications

- Certified Tax Resolution Specialist

- American Society of IRS Problem Solvers

Legal Answers

6 Questions Answered

- Q. I did my sons taxes, he was audited I didn't handle it correctly, can it be fixed?

- A: If you disagree with the results of the audit you may be able to file an audit reconsideration.

- Q. When paying the IRS on back taxes, are the payments applied to the oldest or newest years first?

- A: Typically the IRS will apply your payment to the oldest years first. However, if you indicate on your payment, " please apply to tax year XXXX " they should apply the payment to the appropriate year There are more intricacies in the question you asked and I suggest you have a consultation with a tax resolution attorney in your area.

- Q. I owe the I R S a little over 32,000 in back taxes.

- A: It is my best suggestion to meet with a reputable tax resolution attorney, enrolled agent, or CPA, that offers a free consultation.

Social Media

Contact & Map

S.H. Block Tax Services: Our Family Business Culture

S.H. Block Tax Services: Our Family Business Culture

S.H. Block Tax Services: Client Success Stories

S.H. Block Tax Services: Client Success Stories

SH Block Tax Services

SH Block Tax Services

Stanley H. Block Tax Services

Stanley H. Block Tax Services