Free Consultation: (213) 629-8801Tap to Call This Lawyer

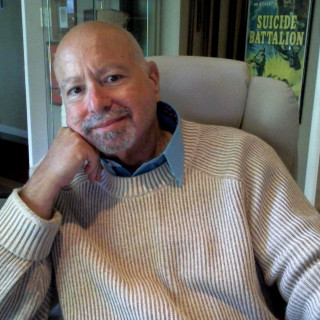

Leon Bayer

Cheap Bankruptcy Lawyer is about cheap fees and quality work.

Badges

Claimed Lawyer ProfileQ&A

Biography

Leon Bayer has successfully represented clients in bankruptcy for over 40+ years. He is frequently called upon by the media, the California Bar and other associations to provide insight and help educate attorneys on bankruptcy issues.

Practice Areas

- Bankruptcy

- Chapter 11 Bankruptcy, Chapter 13 Bankruptcy, Chapter 7 Bankruptcy, Debt Relief

- Consumer Law

- Class Action, Lemon Law

Fees

- Free Consultation

- Credit Cards Accepted

-

Rates, Retainers and Additional Information

Flat fees for most bankruptcy cases, quoted in advance.

Jurisdictions Admitted to Practice

- California

-

Languages

- English: Spoken, Written

Professional Experience

- President (former)

- Los Angeles Bankruptcy Forum

- -

- Served as president of California's leading insolvency professional's organization, 500+ members.

Education

- University of LaVerne College of Law

- J.D. (1979)

-

- California State University, Northridge

- B.A. (1975)

-

Awards

- Volunteer Activities

- State Bar of California

- I have been recognized by the State Bar of California Bureau of Legal Specialization yearly for the past 10 years.

Professional Associations

- California State Bar # 89027

- Member

- - Current

-

Publications

Articles & Publications

- Best Bankruptcy Book

- Bayer, Wishman & Leotta

Speaking Engagements

- Marketing Today: What is SEO Optimization? How and When Can You use Social Media to Boost Your Practice? Does the Phone Book Really Still Work?, 2016 Winter Leadership Conference - Consumer Corner, Palos Verdes, California

- American Bankruptcy Institute

- Other programs include: Los Angeles Lawyer’s Club and the Daily Journal Corporation, from 1999 until the program was discontinued in 2009; Speaker on bankruptcy case law developments at the State Bar of California Annual Meetings, 1984, 1986, 1987, 1988, 1989; Various bankruptcy law educational programs presented by the California Bankruptcy Forum, L.A. Bankruptcy Forum, Office of the United States Trustee, Lorman Education, and many others, too numerous to mention.

- Marketing Today: What is SEO Optimization? How and When Can You use Social Media to Boost Your Practice? Does the Phone Book Really Still Work?, 2016 Winter Leadership Conference - Consumer Corner, Palos Verdes, California

- American Bankruptcy Institute

- Other programs include: Los Angeles Lawyer’s Club and the Daily Journal Corporation, from 1999 until the program was discontinued in 2009; Speaker on bankruptcy case law developments at the State Bar of California Annual Meetings, 1984, 1986, 1987, 1988, 1989; Various bankruptcy law educational programs presented by the California Bankruptcy Forum, L.A. Bankruptcy Forum, Office of the United States Trustee, Lorman Education, and many others, too numerous to mention.

Certifications

- Certified Bankruptcy Law Specialist

- California State Bar

Videos

Legal Answers

298 Questions Answered

- Q. 401k withdrawal without meeting hardship criteria consequences

- A: I have a feeling that your situation probably does meet the hardship criteria, but that maybe you not using the right buzz words when you describe your situation to them. You probably just need some help in writing a better request.

I do think you need advice in-person from a bankruptcy lawyer. You might be able to wipe out the debts without having to borrow money. And of course, borrowed money has to be paid back. It sounds like your credit is already poor, so there might be no downside to filing bankruptcy.

- Q. Hi, my mechanics lien expired on 8/8/2024 but i wanted to enforce the lien. Is there a way I can still enforce it?

- A: What you can do is what you already should have done before the lien expired - you can file a lawsuit, and if you win you can have a judicial lien imposed, and then get a writ of execution to foreclose the lien.

Your lingering problems are two: you have a tendency to sit on your hands, and you may have lost the priority in lien rank that your mechanic's lien used to have over any subsequent perfected creditor liens.

- Q. I put a 5k down for a used vehicle. The dealer did an in house repossession on the 13th day, refuses to refund 5k

- A: I think you have been defrauded. I suggest two things. File suit immediately in small claims court. The case is too small to justify hiring a lawyer, even though for you it was a large sum of money. The other step to take immediately is to file a complaint with the state department of justice - here is their web site for complaints against dealers:

https://oag.ca.gov/consumers/general/cars#:~:text=Filing%20a%20Report%20or%20Complaint,or%20file%20a%20complaint%20online.

Social Media

Contact & Map

Bayer, Wishman & Leotta Los Angeles Amazing 5 Star Review by Mark W.

Bayer, Wishman & Leotta Los Angeles Amazing 5 Star Review by Mark W.

Los Angeles Bankruptcy Lawyer | Bankruptcy Tax Advice

Los Angeles Bankruptcy Lawyer | Bankruptcy Tax Advice

Bankruptcy questions and answers. What you need to know before you file for BK.

Bankruptcy questions and answers. What you need to know before you file for BK.