Free Consultation: (251) 479-0619Tap to Call This Lawyer

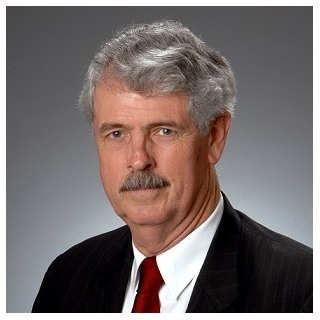

Theodore L. Hall

Badges

Claimed Lawyer ProfileQ&A

Biography

I have been practicing law in Mobile since 1973 and have limited my practice to bankruptcy only for the past 20 years. I also served as a Chapter 7 Trustee for approximately 20 years; and this experience has been a valuable tool in representing debtors in Chapter 7 cases.

Practice Area

- Bankruptcy

- Chapter 11 Bankruptcy, Chapter 13 Bankruptcy, Chapter 7 Bankruptcy, Debt Relief

Fees

- Free Consultation

-

Rates, Retainers and Additional Information

Fees are quoted on a case-by-case basis. Chapter 7 attorney fees must be paid in full before the petition is filed. Chapter 13 attorney fees are paid as a part of the plan payments.

Jurisdictions Admitted to Practice

- Alabama

-

- 11th Circuit

-

Education

- University of Michigan Law School

- J.D.

- -

-

- University of South Alabama

- B.A.

- -

-

Websites & Blogs

- Website

- Theodore L. Hall, Bankruptcy Lawyer

Legal Answers

5 Questions Answered

- Q. how can I find out when I filed bankruptcy?

- A: Ask the attorney who represented you. Or contact the Clerk of the Bankruptcy Court where you filed. Or check the Notice of Bankruptcy or Order of Discharge that was entered in your case.

- Q. My exwife was a cosigner on our home & i have already gone thru chapter 7 now she is threatening to sue me.

- A: It sounds as if you received a chapter 7 discharge, you did not reaffirm the debt on the home, and the judgment of divorce obligates you to be responsible for the home mortgage. And it also sounds as if she is going to sue you in Domestic Relations Court, to hold you in contempt for not paying the mortgage because the mortgage company is now taking action against her. If this is the case, you should speak to a domestic relations lawyer about your exposure under the divorce decree. And you should also contact your bankruptcy attorney to get a clear understanding of what effect the chapter 7 case has with regard to the home mortgage.

- Q. Do I include past deficiency balances (which are included on my credit report) of a repossessed car on the Schedule D?

- A: Assuming the car was the only collateral for the loan (which is typically the case), you would list it on Schedule E/F.

Social Media

Contact & Map