Free Consultation: (484) 415-0144Tap to Call This Lawyer

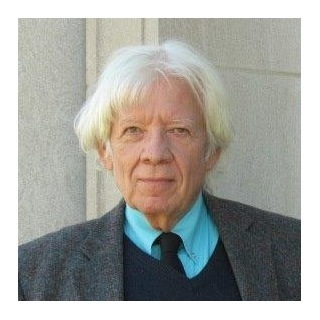

W. J. Winterstein Jr.

Montgomery and Berks County, Experienced practitioner in Civil matters

Badges

Claimed Lawyer ProfileQ&AResponsive Law

Biography

A solo practitioner, I work from a home office in Boyertown, PA, about 30 miles from center-city Philadelphia, and most of my cases are litigated in Philadelphia and Reading courts. With the assistance of local counsel, I also handle matters in Delaware. I have over 30 years experience in both state and federal courts; bankruptcy and mortgage foreclosure/workout are a large part of my practice. There isn't much I haven't seen, or done.

Currently rated "Distinguished" by the "gold standard" of lawyer ratings.

PLEASE CONTACT ME BY EMAIL FIRST, as that is my preference, and more reliable for each of us.

Practice Areas

- Bankruptcy

- Chapter 13 Bankruptcy, Chapter 7 Bankruptcy, Debt Relief

- Collections

- Foreclosure Defense

- Consumer Law

- Lemon Law

- Probate

- Probate Administration, Probate Litigation, Will Contests

Additional Practice Area

- General Civil

Fees

-

Free Consultation

I am happy to chat with you about your issues, for no charge, for up to one hour.

Jurisdictions Admitted to Practice

- Pennsylvania

- Disciplinary Board of the Supreme Court of Pennsylvania

-

Languages

- English: Spoken, Written

Professional Experience

- Attorney

- Law Office of W.J. Winterstein, Jr.

- - Current

- Over 30 years experience in bankruptcy reorganizations, out of court workouts, debtor/creditor, civil practice in all state and federal courts in PA, OK, with practice encompassing NJ and DE through local counsel. Admitted to Third Circuit, Tenth Circuit, and U.S. Supreme Court, and all lower courts in PA.

Education

- Oklahoma City University School of Law

- J.D.

- -

- Honors: Graduated with honors, 2nd of 208, 1976

-

Awards

- BV Rated, Distinguished professionally and personally

- Martindale-Hubbell

Professional Associations

- PA Bar Association

- member

- - Current

-

- Eastern district of PA Bankruptcy Conference

- Member

- - Current

-

Legal Answers

573 Questions Answered

- Q. Can bankruptcy clear my $160K tax debt in MA?

- A: IRS income taxes can be discharged in bankruptcy after three years following the filing oi the annual income tax return(s).

Other types of tax, e.g., taxes secured by a lien, are treated differently.

Best bet, for that much at stake, is to confer with/use experienced bankruptcy counsel.

- Q. Will giving my wife a credit card impact her bankruptcy or my credit?

- A: If your wife files a Ch. 13, she should identify whatever income/payment of debt you provide. In addtion, she should show whatever share of household expenses you provide.

In a Chapter 7, the "curtain" drops on date of iling (wife's eligibility for bankruptcy may be impacted). Probably best to wait to add wife til after bankruptcy filing.

Credit card extensions of credit are addressed to card issuer primarily. As you have Illinois bankruptcy counsel, best is to address these issues to the attorney.

- Q. Do I have a chance to collect on a judgment despite lack of bankruptcy notice and debtor's current assets?

- A: Bankruptcy law seems to recognize that it's unrealistic to burden a debtor with the responsibility to ensure that all creditors' current addresses remain valid, so it is incumbent upon each creditor and/or its lawyer to do so.

In your matter, you updated your address in several public places and could easily have done so in this debtor's case as well.

I believe your lack of notice is due to your own failure to update the debtor's public records.

That said, while the law seems to be cold about diminishing human "discretion", you always add a wild card when a human is added to the process. So, "have a chance"? Of course. Just be prepared for costs and ... Read More

Social Media

Contact & Map